Conditions update from the ECB

The most recent ECB financial stability review is a mine of useful information. Here are a few nuggets from the first chapter: more to follow.

U.S. Cash out refi. As many people don't have much equity left in their homes and remortgage conditions are very difficult, cash out refi and 2nd lien financing has fallen off a cliff. This source of spending money is bound to have an effect even if other things were equal.

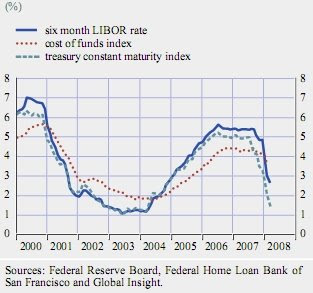

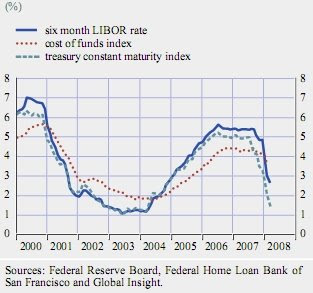

ARM resets. The current low U.S. rate environment should at least cushion the wave of upcoming ARM resets. Here are the three most important ARM rates:

ABCP. This has not completely disappeared, but at $750B volumes are running at around 60% of the pre-Crunch levels. Non asset backed CP has not been significantly affected.

ABS spreads. These remain elevated in all areas, not just RMBS:

Procylicality of the capital rules. Increased volatility, higher credit spreads and decreased diversification benefits means capital requirements are higher even though institutions have been deleveraging. Here for instance is the distribution of changes in VAR for large complex financial institutions:

The role of the structured finance in the Crunch. This is a reasonably even-handed account so the salient points are worth quoting:

U.S. Cash out refi. As many people don't have much equity left in their homes and remortgage conditions are very difficult, cash out refi and 2nd lien financing has fallen off a cliff. This source of spending money is bound to have an effect even if other things were equal.

ARM resets. The current low U.S. rate environment should at least cushion the wave of upcoming ARM resets. Here are the three most important ARM rates:

ABCP. This has not completely disappeared, but at $750B volumes are running at around 60% of the pre-Crunch levels. Non asset backed CP has not been significantly affected.

ABS spreads. These remain elevated in all areas, not just RMBS:

Procylicality of the capital rules. Increased volatility, higher credit spreads and decreased diversification benefits means capital requirements are higher even though institutions have been deleveraging. Here for instance is the distribution of changes in VAR for large complex financial institutions:

The role of the structured finance in the Crunch. This is a reasonably even-handed account so the salient points are worth quoting:

Notwithstanding the positive contribution they can make in facilitating portfolio diversification and the distribution of risk across a wide range of investors ... structured finance markets played a central role in propagating the initial sub-prime mortgage market shock across broader credit markets...

Factors that played a central role in the recent market turmoil included a loss of confidence in the valuation of complex structured products and an increase in uncertainty among investors about the adequacy of their ratings in a context of scant information for risk assessment. This highlighted an already well-known weakness of the originate-and-distribute business model of banks. In particular, it showed that the ability to transfer credit risks may detract from adequate assessment and pricing of credit risk by loan originators and that it can dilute incentives for gathering and passing on accurate information.

Furthermore, some instruments that were intended to facilitate a transfer of risk away from the banking sector fell short of their objective, as the triggering of contractual liquidity clauses brought initially transferred risk back onto the sponsoring banks’ balance sheets.

Investor uncertainty about both the value of structured credit products and the extent to which risk had been redistributed within the financial system by them drove an initial asset sell-off. This triggered a further drop in prices and financial institutions which held such securities were obliged to mark them to market, which led to them having to bear sizeable write-downs. In addition ... important links to third parties in the valuation of the structures came to the fore, such as the role of financial guarantee insurers.

Labels: Markets

0 Comments:

Post a Comment

<< Home